st louis county personal property tax receipt

If paying by mail please make the check payable to. The median property tax in St.

You Can Pay St Louis County Real Estate And Personal Property Taxes Online Fox 2

The StLouis County collector of revenue is currently mailing 2020 personal and real estate property tax bills and has posted the tax amounts due on.

. Individual Personal Property Declarations are mailed in January. Louis City in which the property is located and. The tax rate set by the governing bodies of local governments where the property is located.

Notice of Value Tax Changes will be sent from the Auditors office by mid-July. If personal property taxes are in effect you must file a return and declare all nonexempt property as well as its value. Jackson County Treasurer Tax.

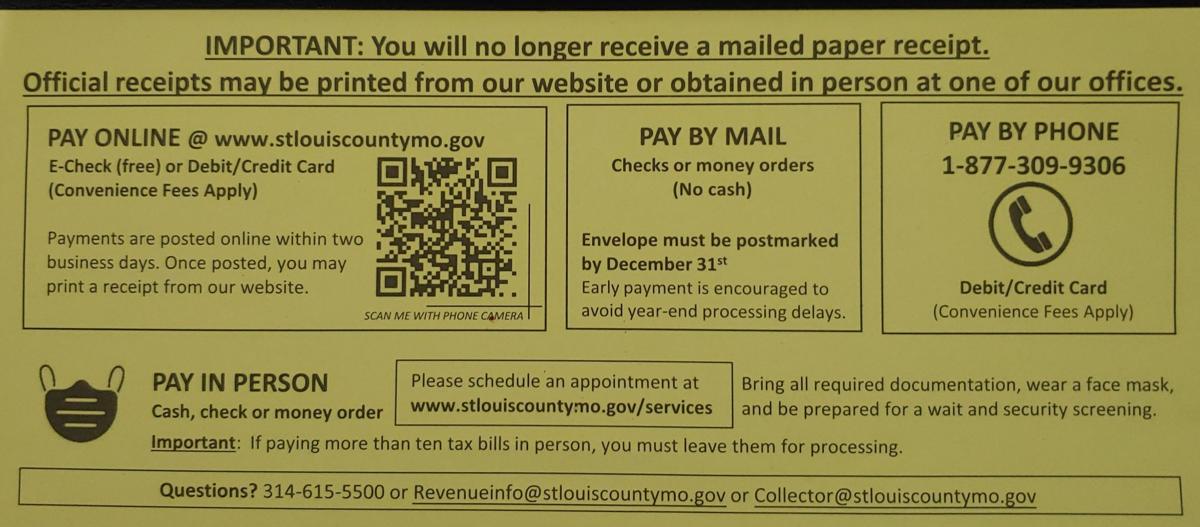

Mail a request stating the account numbers and tax years for which Duplicate Receipts isare requested along with a check or money order for the total number of receipts requested. San Luis Obispo CA 93408-1003. St louis county personal property tax receipt.

Or Pay by Mail. County Tax Collector or SLOCTC 1055 Monterey St Room D-290. 300 North Holden St Suite 204 Warrensburg MO 64093Phone 660747-9822 Fax 660747-7180.

The amount of taxes levied is determined by the tax. The tax is levied as a flat percentage of the value and it varies. Louis County collects on average 125 of a propertys.

Assessments are due March 1. For prior years contact the. Later Wednesday Moore emailed to say.

Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible. Auditors office will start accepting property valuation appeals August 1 through September 15. Use your account number and access code located on your assessment form and follow the prompts.

Obtaining a property tax receipt. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. Obtain a Tax Waiver.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Obtain a Real Estate Tax Receipt Instructions for how to find City of St. All City of St.

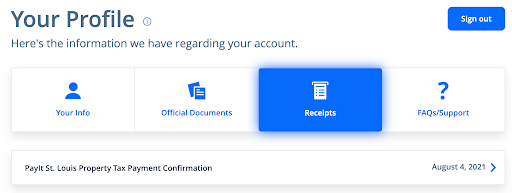

Louis real estate tax payment history print a tax receipt andor proceed to payment. Contact 306 East Jackson Street Tampa Florida 33602 813 274-8211. Taxes paid in the last three years will have a Print Receipt button on the right hand side.

E-File Your 2022 Personal Property Assessment. Search the Real Estate Tax Lookup And Print Receipt application.

Schedule Online With Saint Louis County Mo On Booking Page

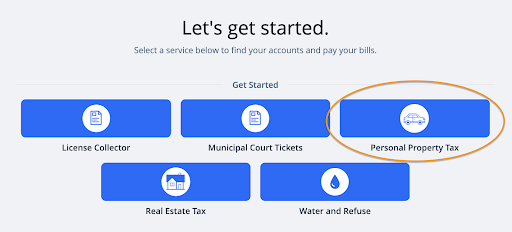

Find Your St Louis Personal Property Tax Account Number Payitst Louis

County Assessor St Louis County Website

Property Owners Real Property Tax Is Due Monday

Collector Of Revenue St Louis County Website

Print Tax Receipts St Louis County Website

St Louis County Directs Residents To Go Online For Property Tax Receipts Politics Stltoday Com

Collector Of Revenue St Louis County Website

Free Missouri Bill Of Sale Forms 4 Pdf Eforms

Can I Deduct My St Louis County Property Tax From My Taxes

Collector Of Revenue St Louis County Website

Warning About New St Louis City Parking Meters Free Self Help Legal Information For Missouri Residents

The Non Profit Paradox 40 Of Real Estate In St Louis Is Government Owned Or Tax Exempt Nextstl

How To Find A St Louis City Personal Property Tax Receipt Online Payitst Louis

Tax Sales Title Insurance In Missouri County Edition True Title